According to Israel Tax Authority (ITA), currencies must have

some “physical manifestation” to be classified as coins. It considers that those who sold large

quantities of bitcoins should pay taxes

The

Israel Tax Authority determined that...

The Bermuda government announced that

public services may be paid, among other things, with the stablecoin USD Coin.

In recent statements issued by the Bermuda government,

it was known that taxes in that country can...

The Investigation Committee expects the

country's legislators to take into account the suggestion it proposes. The idea

is to modify the law and make it able to confiscate cryptocurrencies

Some regulatory entities in Belarus hope...

The gaucho country

is in search of a “smart regulation”, while Brazil works to use the appropriate

terminology to define the uses of each cryptoactive

The

Financial Information Unit (UIF in Spanish) and the Central Bank...

The refusal is due, in part, to the

distrust that banking institutions have for businesses with cryptocurrencies

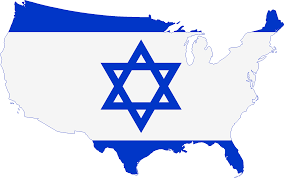

The issue of cryptocurrencies in Israel is uncertain.

In that sense,the position of the financial system with respect...

On June 30, a US court ruled that Kraken must provide its users' information to the Internal Revenue Service (IRS), to investigate those who do not file their taxes. The court ruled that the IRS has...

Taxes on income stemming from the sale of

cryptocurrencies vary, depending on whether they are local or foreign. Since

October 2019, exchanges have had to report the transactions by their

affiliates.

The incorporation of cryptocurrency taxation...

Changes in tax matters would help boost the cryptocurrency

business and establish a clear framework in all legal senses

Japan

has become the first country in the world in which cryptocurrencies have been

regulated. But recently,...

Faced with the devaluation of the

bolivar, cryptocurrencies are a tool for money management in Venezuela. These

are also an option to strengthen the employee-company relationship.

Mariela Llovera, a Venezuelan lawyer and graduate in

Industrial Relations,...

The idea is to boost cryptocurrency

transactions in the country. But this decision does not apply to the payment of

Value-Added Tax (VAT), in the case of companies

Following the steps that Portugal took 15...