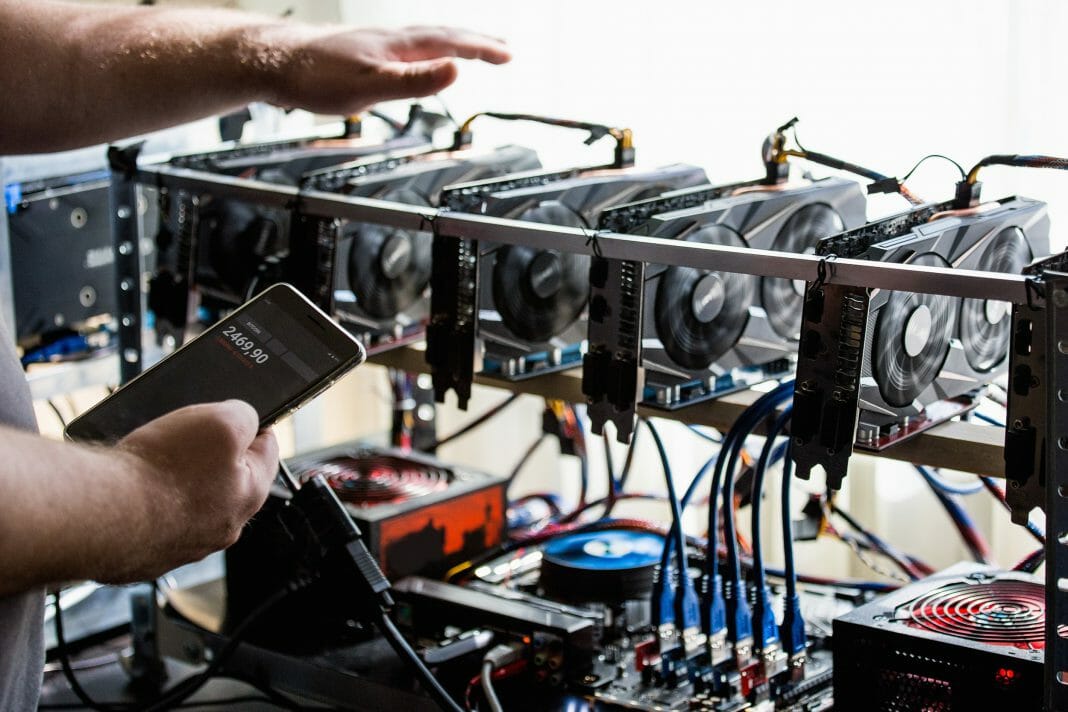

In the next six months, Tether will invest $500 million to enter the world of Bitcoin mining in Latam.

In an exclusive interview with Bloomberg, Paolo Ardoino, Tether’s next leader, revealed the company’s bold plans to enter the world of Bitcoin mining. Tether will invest $500 million in the next six months.

The strategy focuses on the construction of mining facilities in strategic locations, including Uruguay, Paraguay and El Salvador, with the aim of strengthening Tether’s computing capacity up to 1% of the Bitcoin mining network.

Ardoino outlined the company’s vision in detail, highlighting the construction of mining facilities with capacities ranging from 40 to 70 megawatts (MW) in these selected countries. Additionally, part of the funds will be used to finance the German mining company Northern Data Group, thus solidifying Tether’s position in the cryptocurrency mining sector.

Joana Cotar, Bundestag Deputy, Pushes for the Recognition of Bitcoin as Legal Tender in Germany

Bundestag deputy Joana Cotar has openly expressed her support for the recognition of Bitcoin as legal tender. This announcement raises the possibility of a paradigm shift in Germany’s position towards cryptocurrencies, thus challenging the European Central Bank’s efforts to develop a central bank digital currency (CBDC).

Cotar’s initiative seeks to explore the integration of Bitcoin into the heart of German finance through a “preliminary examination” aimed at establishing a legal framework that formally recognizes Bitcoin as legal tender. Its approach is not limited to Bitcoin acceptance alone, but advocates the creation of a balanced regulatory environment, with special emphasis on legal security for companies and citizens.

Criticism of SEC’s Gary Gensler: Ripple and the Crypto Community Argue Contradictions Between Words and Actions

In response to a recent speech by Gary Gensler, chairman of the United States Securities and Exchange Commission (SEC), Ripple’s lawyer and several prominent members of the crypto community have expressed criticism. Alleging that Gensler’s statements do not match his actions.

Gensler delivered his speech during the 2023 Securities Enforcement Forum on November 16, where he highlighted the words of the SEC’s first chairman, Joseph P. Kennedy. In the speech, Gensler emphasized the need for the SEC to be “a partner to honest business and a prosecutor to dishonesty.”

However, these statements generated immediate responses from members of the crypto community. Stuart Alderoty, legal director of Ripple, questioned Gensler’s consistency, arguing that his recent comments contrast with his actions, accusing him of having “prejudged cryptocurrencies and having sued others without proper investigation.”

This criticism comes amid growing tension between Ripple and the SEC, with Alderoty and others questioning the impartiality and objectivity of the commission chairman, who is currently immersed in a legal battle with the SEC.

SEC Delays Decision on Grayscale Ethereum Futures ETF, Increasing Uncertainty in Crypto Market

The US Securities and Exchange Commission has postponed a decision on the Ethereum futures exchange-traded fund (ETF) introduced by Grayscale Investments. The application, filed in September, proposes a fund that would allow investors to buy shares based on the outlook for the future price of Ethereum.

However, the SEC announced the delay in making a decision, a common practice when it comes to cryptocurrency-related products. In its statement, the SEC indicated that it believes it is appropriate to designate a longer period to evaluate the proposed rule change, thus providing the time necessary to deeply analyze the problems presented.

By Leonardo Perez