When an organization or

enterprise accepts several payment methods for selling its goods or

merchandise, it opens up new horizons in potential sales and profit. However,

if it really wants to reach the next level of success in marketing, it...

Workers are interested in Bitcoin after the apparent end of the bearish

market. The payment represents 30% of all the

employees. Some people think the payment should not be calculated with dollars

In a

publication shared...

South

Korea and Indonesia are the next regions with the most reception of

cryptocurrency exchanges. Rich countries are the ones that most invest in

digital assets

Recent research

showed that The United States and Japan are the...

It is expected that the official launch of the

SIX stablecoin will take place by the middle of 2020

In a recent press release, spokespersons of the

Swiss exchange company SIX revealed they are developing...

The development would benefit emerging

economies and unbanked people

Whilst the boom of digital

currencies causes some banks to fear to lose their monetary policies, others

seem interested in creating their own cryptocurrencies to

conduct digital transactions...

Spokesmen of the Central Bank of Laos,

claim that they do not have an optimal security system to

protect its citizens from illegal transactions if they use cryptocurrencies

Recently, the Central Bank of The Lao...

AT&T does not need an introduction. It is one of the

largest American enterprises, considering all fields and sectors, with a

noteworthy track record on telecommunications. It provides mobile phone

services and owns a mass media network that includes some...

Part of the procedure established in the bill is to inform both

authorities and investors about all the

details of a sale token. In addition, it is sought to avoid that the

information provided is false

Experts say that the value of Bitcoin could

again reach $ 14,000. They say this situation is similar to the rise of the end

of 2017

As reported a few days ago in a recent...

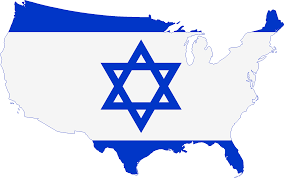

According to Israel Tax Authority (ITA), currencies must have

some “physical manifestation” to be classified as coins. It considers that those who sold large

quantities of bitcoins should pay taxes

The

Israel Tax Authority determined that...